Personal Loans

Need a personal loan that comes with a great rate and a repayment term that suits your budget?

View Personal loan Offers

Need a personal loan that comes with a great rate and a repayment term that suits your budget?

View Personal loan Offers

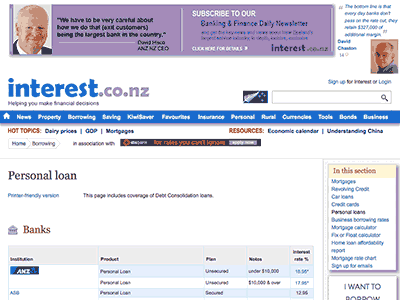

With such a vast range of personal loan available in New Zealand, comparing lenders is the best way to secure a loan.

Don’t simply accept the first loan offer that comes your way, take some time to browse through these top lenders.

A personal loan can be used for almost anything and can range in size depending on your loan agreement.

Apply for a personal loan in New Zealand by quickly and easily finding the ideal loan online that meets your needs and suits your budget. Finding the ideal loan that offers you a good rate, flexible loans terms, the ideal loan amount and quick loan delivery is best done to compare loans online.

A personal loan is known as an unsecured loan because the loan does not have to be secured by an item of collateral so they are a lot less risky for you as a client.

When you apply for a personal loan you will need to know how much you need to borrow and how long you will need to pay it back. You will also need to know what your credit score is. Apply for a copy of your credit report and look for any mistakes that may be listed and make sure they are corrected before you apply for a loan.

Your credit report is a list of all your financial history, both good and bad. The more financial transgressions that you have, the lower your credit score will be. If you have a low credit score, then your loan terms will be a lot more strict and you may only qualify for a reduced amount or what is known as a bad credit loan.

A personal loan is not a revolving loan like a credit card or an overdraft facility. A personal loan needs to be repaid in instalments and has a fixed end date. Terms usually range from 2 to 5 years and carry a fixed interest rate so you always know exactly how much your payments will be each month.

To repay your personal loan, most lenders require that you set up a direct debit on your account that runs automatically according to your pay frequency.

When you sign a personal loan contract you will agree to pay off the entire amount on an agreed upon date. This fixed term contract allows you to space out your payments and manage your budget more easily.

If you struggle to make repayments and get behind on your long or short-term loan, then it could end up costing you a lot more than you originally intended. If you default on payments the lender could take legal action against you.

Make sure you know what the payment policies are as some lender will charge you penalty fees and extra charges if you repay your loan early.

There are many reasons that you may apply for a personal loan and if used responsibly then it can help you get back on top of your finances and help you out of a sticky situation.

You will be able to get the most out of your personal loan by using it wisely. Use a personal loan to consolidate your credit cards and diminish your debt.

If you are relying on credit cards to pay bills and make it through the month and you are struggling to pay off multiple credit cards, then you could use a personal loan to consolidate your credit card debt. This method allows you to pay off your existing debt at a lower interest rate.

Debt consolidation allows you to save a lot of money and not need to worry about juggling multiple payments.

Ignoring your debt and hoping it goes away on its own is not an option and you will accumulate late fees and other penalties. If you don’t let the lender know you have a problem, then they may seek legal action against you.

Student loans cost a lot of money and usually carry a very high-interest rate charge you could use a personal loan in order to consolidate your debt. Make sure you know what the terms and conditions of your student loan or as some come with special benefits that may no longer apply if you refinance it.

You can also use a personal loan to pay for a big purchase so that you don’t need to buy it on credit and push yourself further into debt.

The two main types of personal loans include secured and unsecured loans. An unsecured personal loan does not require you to provide security against it and includes payday loans and short term loans. This loan is based on your financial history and your repayments terms will depend on your credit score and other factors.

A secured loan means that you will need to supply an item of collateral. This can be your home or any item of value that is more than the loan amount. The problem with a secured loan is that if you miss payments then you could end up losing your home or car and you will be in a worse position than you originally were.