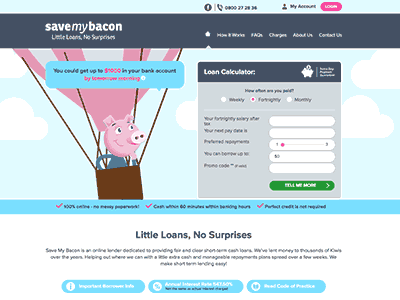

SaveMyBacon

- Short-term loans up to $5,000

- Low-interest up to 49.95%

- Repayment up to 12 months

In-page navigation

[Accessed April 17, 2018]

Save My Bacon - A reliable finance partner

We are a financial services provider that is constantly seeking to uplift every New Zealand citizen. We know how difficult it is to be looking for credit during a hard time with no one to turn to.

Save My Bacon is that one organization, you can count on when you are looking for a short-term loan. Unlike most banks, we are not interested in as paperwork as the banks would request. Instead, we are more concerned about helping you getting credit as soon as possible.

Adhering to the terms and conditions

The last thing we want to do is give our clients big shoes to fill. Although we are not saying our customers aren’t capable of achieving our expectations, meeting your financial obligations requires an immense amount of discipline.

As such, Save My Bacon is committed to helping clients that show an eagerness to paying off their debts as opposed to someone who just wants assistance with a small payday loan.

As much as we are in the business of helping clients, we are also in the business of ensuring that we give credit to people that will be able to settle their debts.

Transparency is the key

To us, maintaining a level of truthfulness goes a long way. We will never give you ridiculous amounts of interests and expect you to pay them by the end of your loan period.

We will be straightforward and upfront about every service we give to you because we are not a credit provider that lies.

SaveMyBacon Services

As we all know, a short-term loan is when someone asking for credit that will settle in a short period of time.

The Mini loan is similar to a short term. If a client requires a slightly bigger loan, he will have to seek some of our other options in order to be catered for.

Loan application at Save My Bacon

The first step is applying for a personal loan through our online application process.

The application is straightforward and doesn’t take more than 10 minutes to complete.

Depending on how fast you are, you might be done in less than 10 minutes. Once you have submitted the online application, your work is done.

Loan assessment and verification

After your short term loan application has reached us, we will need to verify whether you can afford the loan that you actually applying for.

This we do through a number of assessment series such as asking for your payslip, bank statement as well as your proof of residence address.

If you don’t give us the paperwork that we ask from you, your online loan application will be dismissed. We need to ensure that all rules and regulations are followed.

SaveMyBacon – Short-term loan

- Loan Type Short-term loans

- Interest Rate 49.95%

- Loan Amount up to $5,000

- Repayment 7 days to 12 months

Benefits of SaveMyBacon

- Fast approval

- Funds available within a few hours

- No fees for early repayment

Short-term loan calculator

Save My Bacon - Quick online loan application

Depending on what time of the day the loan was approved as well as the bank you use, the money will reflect in your nominal bank account today or the following business day. Unfortunately, we can’t be held liable for bank’s times.

Who can apply for a Save My Bacon Loan?

Customers who are the age of 18, live in New Zealand or permanently reside within the borders, somebody who is working and earns a certain amount of money. If you don’t meet our requirements, we will be forced to reject your online loan application without even reading all the other details of your loan profile.

Can I repay my loan early?

Clients are more than welcome to repay their advance earlier than the payment period. If they don’t and skip a month instead, they will be liable for dishonesty fees. However, if you are interested in paying your instant cash loan earlier than the required date, you will have to give us a call and we will discuss it further.

What if I skip my repayments?

We understand that things get a little difficult from time to time and you might have a problem. That said, we will be willing and open minded allowing the client to pay at a later stage. As long as you notify us on time because if you don’t, they will think it is AWOL.

Know your financial limits

As easy as taking out a loan for certain clients sounds, there is a lot one has to take into consideration. For starts, if you don’t meet your financial deadlines, things can go from bad and as lightly stain the potential of ever applying for another one of our short-term loans in the future.

The last thing you need is to ruin your credit record over something that you could have waited for until you get paid. Seeing that most clients will always require a little bit of financial push in the right direction, a loan will always come in handy when you need it.

Patience is the key

Try to be as calm as possible because when you have a lot of money at your disposal, you will have very little temptation to worry about. Always wait if it is something that can hold you until your next day. However, if it is something that requires your immediate attention, you will need to do it right away.

SaveMyBacon is a trusted & reliable provider of short-term loans

In our review, SaveMyBacon adheres to the compliance criteria in accordance with the Credit Contracts and Consumer Finance Act 2003, where the granting the loan will not cause financial distress to the consumer.

SaveMyBacon is a registered credit provider in New Zealand: FSP FSP 41567

Customer Reviews & Testimonials

SaveMyBacon Contact

Physical Address

- 150 Lichfield Street, Christchurch Central City Christchurch 8011 New Zealand

- Get Directions

Postal Address

- PO Box 8496, Christchurch, 8014, New Zealand

Opening Hours

- Monday 08:00 – 17:00

- Tuesday 08:00 – 17:00

- Wednesday 08:00 – 17:00

- Thursday 08:00 – 17:00

- Friday 08:00 – 17:00

- Saturday Closed –

- Sunday Closed –